Key Movements And Emerging Trends Across Mortgage Networks in 2025

The movement of Appointed Representative (AR) firms among networks during Q1 of 2025 reflects the sector's continued evolution and dynamism. Building on the momentum of 2024, the first quarter's data offers valuable insights into gross and net year-to-date (YTD) changes, highlighting the most significant winners and losers, also uncovering emerging trends.

Net Changes in AR Firms: A Snapshot of Q1 2025

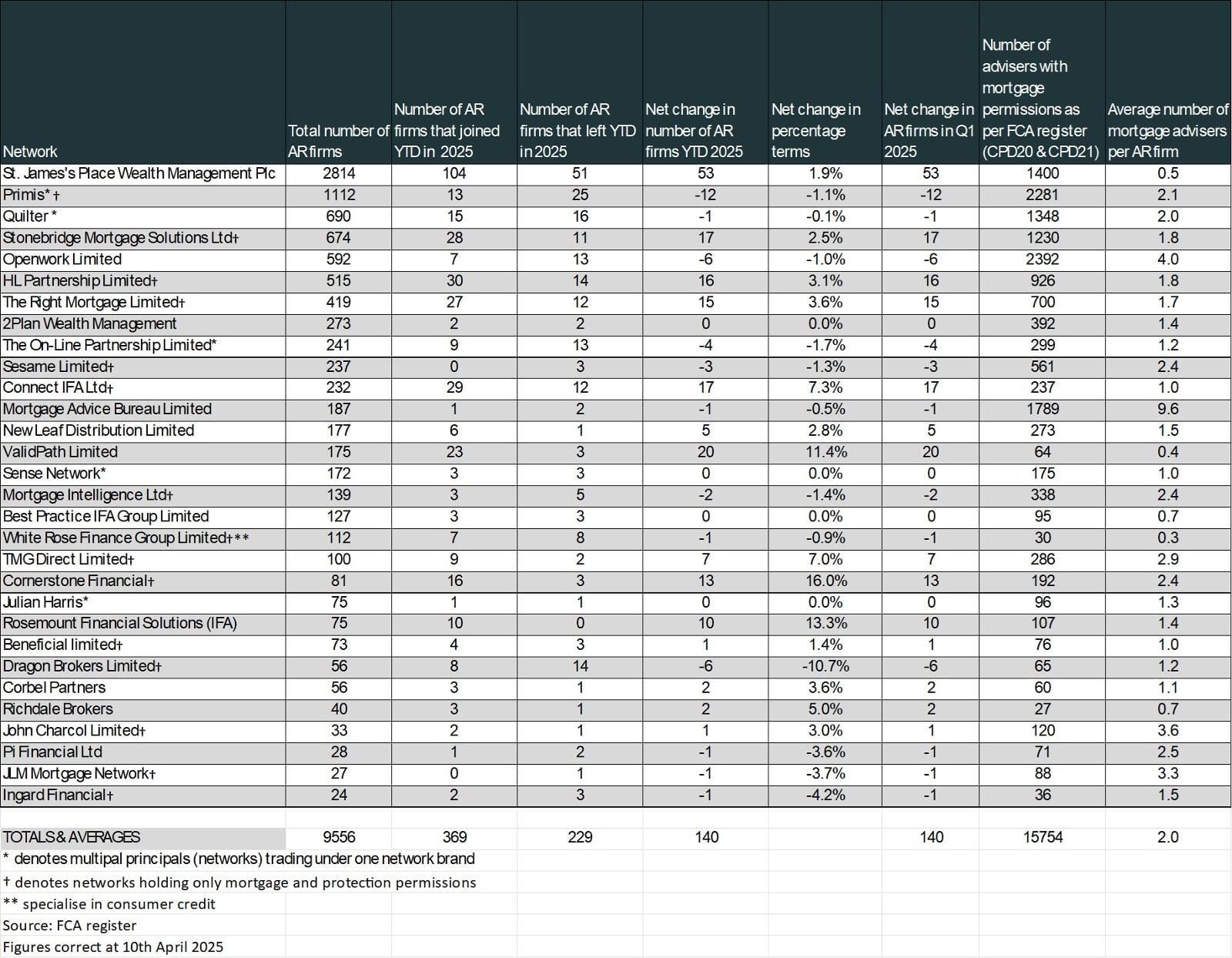

The first quarter of 2025 saw a net increase of 140 new AR firms across networks with more than 20 AR firms, underscoring the positive trajectory of the AR model within the mortgage sector. This growth illustrates the resilience and adaptability of some networks in responding to evolving market demands. The emergence of new networks further reinforces this upward sentiment, signalling robust confidence in the AR framework.

However, the growth in AR firm numbers has not translated into a corresponding rise in adviser numbers. Instead, the overall count of mortgage-permitted advisers has remained relatively steady, with a modest decline of 13 advisers during the same period, for the networks that appear in the table. This divergence potentially suggests a shift in industry dynamics, where more advisers are choosing to leave larger practices to establish their own firms. This trend aligns with many of our recent enquiries expressing advisers' interest in starting their own businesses.

Additionally, data from Network Consulting, drawn from a Freedom of Information request to the FCA (see article in mortgage strategy), reveals a substantial decline in Directly Authorised Firm approvals over the past five years. Together, these developments strongly indicate a growing preference for the AR model as the industry adapts to changing adviser needs. Added to which, many believe that the process to become DA along with the strains of both Consumer Duty and FCA reporting have added to the decline in DA firm approvals. Given that the FCA have recently announced they are opening consultation on reducing the reporting requirements (closes 14th May), this may have some form of impact on firms’ preferences on which route to take.

Winners and Losers: Performance Analysis of Networks

In percentage terms, Cornerstone Network has emerged as the top-performing network this quarter, achieving an impressive 16% net increase in AR firms YTD. Rosemount Financial Solutions (IFA) closely follows, with a notable net increase of 13.3%.

Conversely, Dragon Brokers recorded a net decrease of -10.7% in Q1, though this only represents a differential of six firms. Meanwhile, Primis and Openwork have continued their long-standing trends of declining AR numbers. Openwork has suffered consistent firm losses each quarter for the last three years, amounting to a total net loss of 107 firms since January 2023. Primis has experienced only one quarter with a net gain of AR firms during the same period, attributed to the acquisition of TenetLime in Q1 of 2024.

This presents a noteworthy point regarding acquisition in the larger scale. Taking on a large number of multi adviser firms in one go will need an infrastructure that’s able to continue an acceptable level of service and regulatory oversight. When 2Plan took on the firms from the other Tenet Group networks last year, they agreed with the FCA that they would suspend recruitment of multi-adviser firms until their infrastructure had caught up. Which at the point of writing was still in place but it is believe that this will be lifted imminently.

Implications for Networks

The contrasting trends of growing AR firm numbers and stable adviser counts mark a critical juncture for adviser support services. Networks must proactively address these changes by offering tailored support and fostering environments conducive to today’s marketing trends and entrepreneurial growth. The ability to attract and retain AR firms will depend on a network's commitment to innovation, compliance, and adaptability.

Conclusion: Navigating a Dynamic Landscape

As we progress through 2025, the movement of AR firms provides valuable insights into the mortgage intermediaries sector's transformation. Networks that can focus on client outcomes, anticipate market shifts and strategically adapt to emerging trends are well-positioned to thrive in this competitive and dynamic environment.