2024 in Network News: A Recap

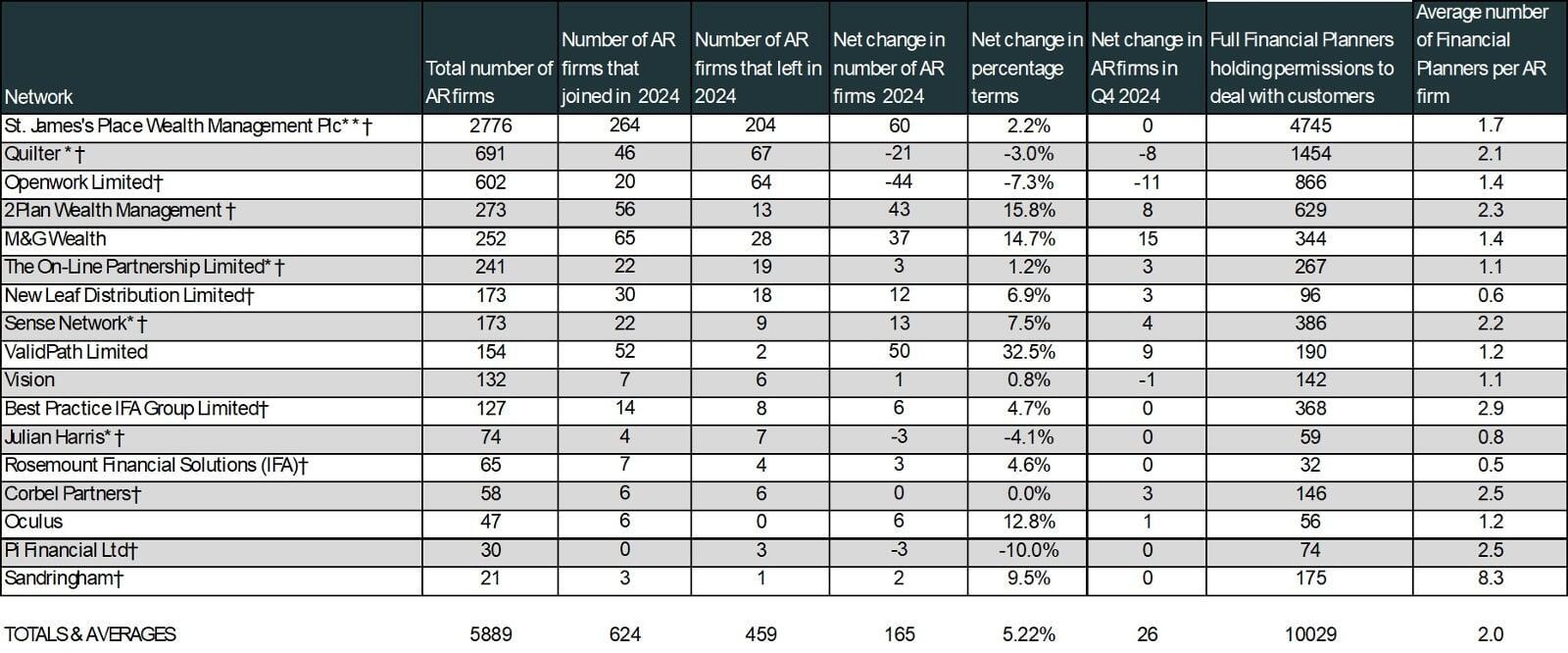

This report presents the first-ever table showcasing AR numbers, adviser counts, and firm movements among financial planning networks. The objective is not to determine which networks are "best"—a subjective matter—but to track movements and trends in the network/Appointed Representative (AR) space.

While being an AR within a network might not suit everyone, networks provide a robust structure for thousands of firms. However, selecting the right network is crucial, amongst many things, advisers and firms should match their values, fully understanding the proposition, restrictions, and particularly the exit terms before joining.

There has been significant talk and activity surrounding market consolidation, with many venture capitalists and large institutions on acquisition hunts, including some of the names in the table. Ernst & Young reported a total of 380 mergers and acquisitions in the advisory space throughout 2024, indicating a highly active area. This activity may affect consumer and adviser choice, but despite whispers of a decline in advice distribution, the industry's overall AR and adviser numbers suggest market stability. However, there's a recognised need for strong pathways to bring new entrants into the adviser population to maintain consumer choice.

Among networks primarily offering full financial planning, Tenet and SJP were the biggest discussion points in 2024. St James’s Place stands out due to its size, boasting more AR firms and advisers than the rest of the top ten combined. However, the year was challenging for this network giant, as it made headlines for "overcharging for annual reviews", Early Withdrawal Charges and briefly exiting the FTSE 100 in May before rejoining in December. Despite these issues, SJP's new firm and adviser intake was not significantly impacted, although they ended the year with a zero net increase in Q4.

In 2023, Tenet Group announced the sale of all its network brands, which finalised in H1 2024, when it bid farewell. The mortgage and protection arm, TenetLime, bought by LSL, with the remaining AR firms in TenetConnect and TenetConnect Services transferred to 2Plan as part of the sale. Sadly, in June 2024, the group appointed administrators, marking the end of an era. Fortunately, this event did not have any impact on the wider market.

The table highlights that the three largest networks by AR firm numbers experienced the highest number of AR firm departures. SJP lost 204 firms over the year, followed by Quilter with 67 and Openwork with 64. However, the net figures reveal the true growth or loss.

Both Quilter and Openwork experienced the greatest net loss of firms in 2024, losing 21 and 44, respectively. These figures followed similar losses in 2023, with both networks experiencing an identical net loss of 56 firms each.

The winners in the growth stakes last year included SJP, with a net increase of 60 firms (2.2% growth). However, ValidPath stood out with significant net growth of 50 firms, representing a 32.5% increase. Special mention also goes to 2Plan, owned by Openwork, which had a net increase of 43 firms, equating to a 15.8% growth. When considering joining a network that has experienced rapid growth, it is wise to check the infrastructure has caught up and service levels aren’t adversely impacted.

Overall, networks with more than 20 AR firms grew by 165 firms in 2024, a 5.22% increase. There are no figures available to determine whether this growth comes from new firms set up by breakaway advisers or migration of Directly Authorised firms. Regardless, it will be interesting to see if this trend continues through 2025.

In terms of investment advisers numbers, this is steady, in-fact, figures produced in the FCA retail intermediary annual data, illustrates a net increase of retail wealth advisers over recent years. The annually published data should be available in Q3, so it will be interesting to see how investment adviser numbers faired in 2024 compared to those with mortgage permissions, which dropped by some 1500. See Mortgage League Table for 2024.

Adviser numbers by year

- 2013 - 34,429

- 2014 - 34,820

- 2015 - 34,316

- 2016 - 34,357

- 2017 - 34,876

- 2018 - 35,568

- 2019 - 36,279

- 2020 - 36,252

- 2021 - 36,330

- 2022 - 37,129

- 2023 - 37,023