During the last quarter there have been a couple of stories within network land that may not have caught your attention. Firstly, recently advertised on Forbes Burton business consultants website, is an unnamed mortgage network up for sale. Although consolidation is inevitable, as I’ve written previously, there are new challenger propositions that have entered the market and more coming. Secondly, HL Partnership announced what they describe as a ”strategic Investment” from The Better Home Group, a major player from South Africa.

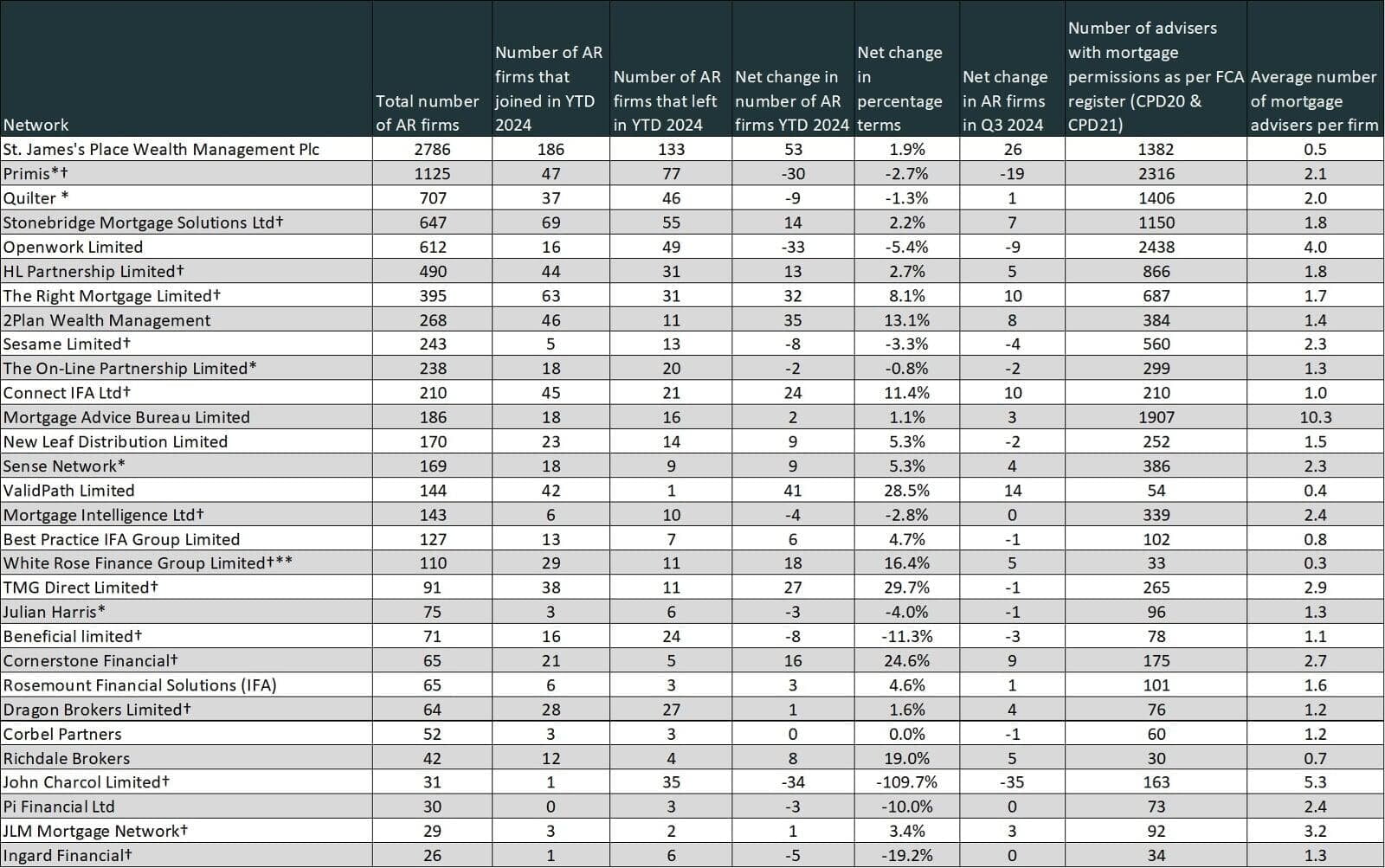

Before we look at the movements illustrated in the table, those that follow it may well have noted that MAB appeared to have not recruited any new firms in 2024. However, it became apparent that all new firms had been recruited in to a different company in the group, Mortgage Advice Bureau (Derby) Limited and were therefore not included in previous tables. This has now been remedied and the correct number of joining firms now included.

When we look at the data, it looks as though John Charcol have had a massive loss of firms. However, most of the firms that appear to have left, were single adviser firms and many of the advisers have remained with John Charcol as RI’s. Clearly, following LSL completing the purchase of John Charcol in April, they have just restructured their AR model, so not as bad as it first appears.

The networks that have experienced the most sizable growth in the mortgage market are The Right Mortgage Network with a net gain YTD of 32 firms, however we have to mention TMG again with an impressive growth in firms numbers YTD of 29.7%, closely followed by Cornerstone with a growth of 24.6%. TMG experienced their first loss of firms of 2024 in Q3, losing 12 firms, which was a net loss of 1 as they on-boarded 11 in the same period.

The FCA register doesn’t have the functionality to monitor new and leaving mortgage advisers, but by using data we have pulled at various points throughout the year, we can say is that there has been in a net increase in mortgage adviser numbers of 334 across the networks displayed. This is not affected by the omission of MAB new firms but is slightly skewed however, because Sense network appear to have added mortgage permissions to a large number of advisers that didn’t have them previously. So the true adviser growth number over the same period is closer to 130, which is still encouraging.

There are some very strong network propositions and the network model is still enjoying net growth in new firms both YTD and in Q3, despite the “false” loss of 35 firms for John Charcol. Choosing the right model for any adviser business is imperative for long-term, profitable and uninterrupted journey. There are offerings that will suit most businesses and more choice is likely to come to the market in the coming year.