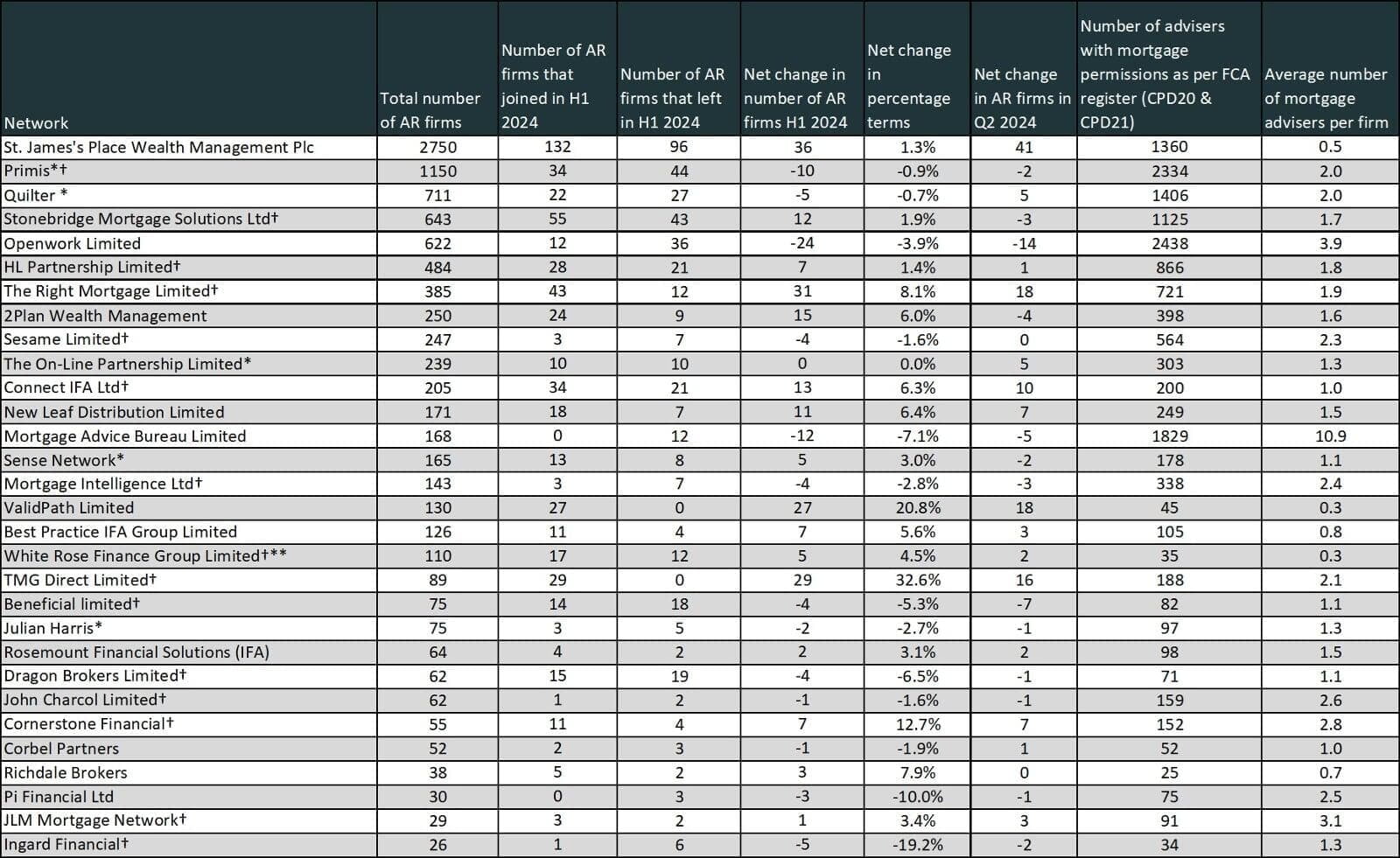

Network League Table - H1 2024

For more information on individual networks, click Network Directory below

The data source for the table below is the FCA register and was correct at 5th July 2024.

It illustrates the movement of Appointed Representative firms for each network over the period 1st January 2024 to 30th June 2024.

It is prioritised by total number of AR Firms, adviser numbers for this table only include mortgage advisers.

The size of a network does not mean they will be best for you. If you're looking for a network, please get in touch and let us help find the best one for YOU.

* Denotes networks with multiple networks under one brand.

** Denotes network specialising in consumer credit

† Denotes dedicated mortgage networks.

CPD20 mortgage advisers, CPD21 equity release.

For more detail regarding the table and how they are collated, please go to the Network League Table overview

Read the Mortgage Strategy article here; https://www.mortgagestrategy.co.uk/news/mortgage-network-ar-figures-increase-132-in-h1-2024/?eea=*EEA*&eea=MWlXWm9IQW96Umc0ZjRXTUtjdnNyazJSTjJMZU02Y0MwT3Z0Wmt2VjZFRT0%3D&utm_source=acs&utm_medium=email&utm_campaign=INDIGO_MOST_EDI_ALL_Latest_180724&deliveryName=DM254478

In the last network round up for Q1, I stated that this quarter should draw a line under demise of Tenet. However, by the middle of Q2, Tenet remained in the headlines when the Tenet Group appointed administrators, as reported by many industry publications on the 5th June. This final move should bring the last word in the whole Tenet saga. Thankfully, the vast majority of staff and advisers affected have found new homes.